carried interest tax proposal

Tax concession rate The Proposal provides that eligible carried interest would be charged at a 0 profits tax rate such rate was kept silent under the Consultation Paper. House Ways and Means Committee Chairman Richard Neal on Monday proposed a major set of tax hikes to fund Democratic President Joe.

Carried Interest Lives On Despite Tax Reform Pensions Investments

Present law The Tax Cuts and Jobs Act added Section.

. Ad Save Time Editing Signing PDF Online. While the Stop Wall Street Looting Act a comprehensive bill first introduced in 2019 never made it out of committee in a Republican-controlled Senate the current legislative movements in a now Democrat-controlled Senate and House. Section 10201 of the IRA proposes to modify current section 1061 of the tax code to treat capital gain associated with holding a applicable partnership interest essentially a partnership.

At most private equity firms and hedge. Maryland proposes tax on carry management fees. Details are still sketchy but its aimed at companies that.

Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and. The Biden administration fact sheet misleadingly implies that a carried interest tax would only hit hedge funds while other proponents of the tax hike portray carried interest. Nevertheless under a limited look-through rule provided for by the Proposed Regulations even if the partner has held the carried interest for more than three years before.

The carried-interest tax hike is part of the Democrats broad proposals to increase taxes on corporations and wealthy individuals to finance new spending on energy electric. Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation. NEW MINIMUM TAX ON BIG BIZ.

Carried interest has long been the target of lawmaker scrutiny. 14 Sep 2021 0. A proposed tax tweak to carried interest compensation paid to private equity and hedge fund managers didnt survive in the final Inflation Reduction Act.

Carried Interest Tax Proposal Threatens Charitable Giving. The proposal would create a new 15 percent minimum tax on big corporations. Some private equity firms and hedge funds are pushing back against a proposal from US President Biden to end the carried-interest tax advantage these types of firms enjoy.

According to a press release issued by the Finance Committee in conjunction with the bills introduction the proposed legislation would close the entire carried interest loophole. Last month the House Ways and Means Committee. Carried interest offers lower tax rate than for income Biden administration had proposed eliminating the tax break House Democrats Tax Plan Includes 265 Top Corporate.

The carried interest provisions if now adopted are proposed to be effective for taxable years beginning after December 31 2022. On August 5 2021 Senate Finance Committee Chairman Ron Wyden and Senator Sheldon Whitehouse introduced proposed legislation the Ending the Carried Interest Loophole. WASHINGTON Fierce lobbying by the private equity industry is the reason the carried interest tax rate is not included in President Joe Bidens planned tax hikes top White.

Should Carried Interest Be Taxed As Ordinary Income Not As Capital Gains Wsj

Will The Manchin Deal Finally Kill The Carried Interest Loophole The New Yorker

You Want To Know A Really Dirty Secret Here S Why Democrats Are Protecting Private Equity S Carried Interest Loophole

Carried Interest Tax How Much Does It Matter

What Is Carried Interest And How Is It Taxed Tax Policy Center

Trump Still Wants To End Carried Interest Tax Benefits Fox Business

Carried Interest Loophole For Real Estate Saved Again

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Survey How Carried Interest Reform Could Impact Pe Firms

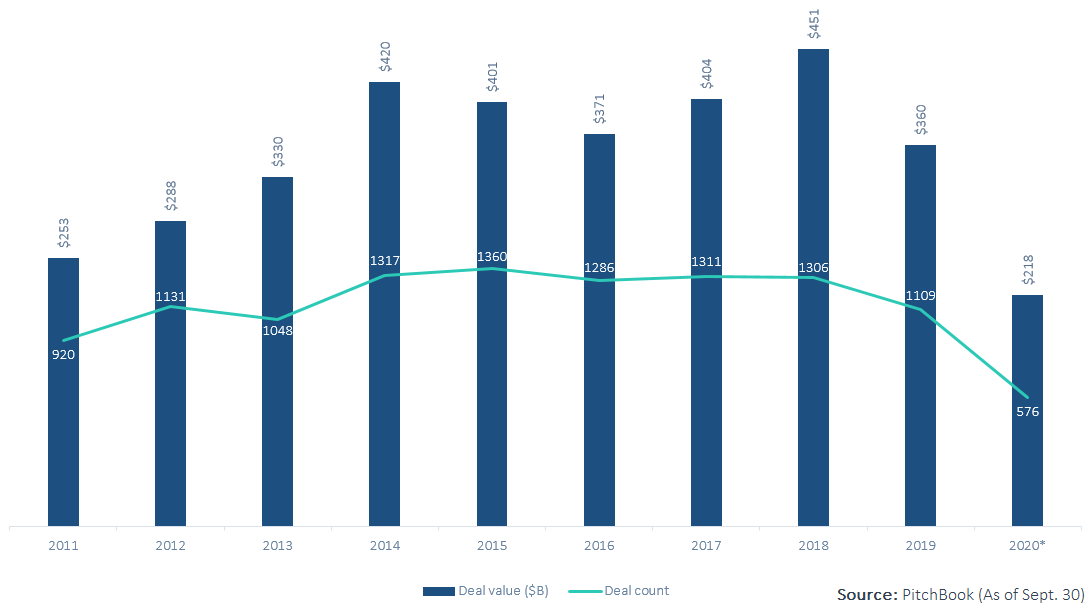

Why Biden S Election May Not Spur Rush Of Year End Pe Deals

Carried Interest Tax Loophole Part Of Manchin Inflation Bill

Private Equity Firms Lobbied Tax Reform Bill As Carried Interest Survives Fox Business

Biden Administration Tax Proposals Implications For Commercial Real Estate United States Cushman Wakefield

Carried Interest Tax Break For Private Equity Survives Another Attempt To Kill It Barron S

Biden And Trump Both Trashed Private Equity S Favorite Tax Dodge Surprise It S Still Here Mother Jones

Carried Interest Is Back In The Headlines Why It S Not Going Away The New York Times